You know the feeling: the summer heat spikes, your air conditioner runs non-stop, and you dread opening the mailbox to see your electricity bill. For many families, cooling costs represent the single largest fluctuating expense in their annual budget. While you cannot control the weather, you certainly can control how efficiently your home uses energy.

If your cooling bills are still too high for your comfort, you might consider picking up some summer side hustles to bridge the gap in your seasonal cash flow.

Cutting your cooling costs doesn’t require living in an uncomfortable sweatbox. By combining smart habits, minor maintenance, and strategic home improvements, you can significantly reduce your energy consumption. This guide outlines a practical strategy to help you keep your cool physically and financially this season.

Key Takeaways

- Optimize airflow: Simple changes like changing filters and using ceiling fans correctly can lower costs immediately.

- Block the heat: Managing window coverings and reducing internal heat sources prevents your AC from working overtime.

- Program for savings: Smart thermostats and proper scheduling can save you up to 10% annually on heating and cooling.

- Audit your insulation: Sealing air leaks provides the highest return on investment for long-term energy savings.

- Know your utility programs: Many providers offer “budget billing” or time-of-use discounts that stabilize your cash flow.

Audience Scope

This guide is for U.S. residents—homeowners and renters alike—looking to lower household utility expenses through practical behavioral changes and minor home improvements. If you have complex circumstances such as owning a large commercial property, historic homes with restricted renovation codes, or if you are considering large-scale solar investments, we recommend consulting with a qualified specialist or contractor.

Understanding Your Energy Usage

Before you can cut costs, you must understand where your money is going. Air conditioning often accounts for about 12% of total U.S. home energy expenditures, but in hotter climates during peak summer months, that number can easily triple. The goal is efficiency: getting the maximum amount of cooling power for every dollar spent.

To protect your finances from these seasonal spikes, it is wise to learn how to build an emergency fund from scratch to cover unexpected costs.

According to the Consumer Financial Protection Bureau (CFPB), utility costs are a major factor in household budgeting, and sudden seasonal spikes can destabilize even a well-planned budget. The key to reducing this bill is reducing the “load” on your air conditioner. Every degree of heat you prevent from entering your home is money saved.

“A budget is telling your money where to go instead of wondering where it went.” — Dave Ramsey

Immediate, No-Cost Adjustments

You can start saving money today without spending a dime. These behavioral changes focus on optimizing your current setup.

Finding ways to save money while still enjoying life is essential when balancing comfort and cost during the peak summer months.

Adjust the Thermostat

The most effective way to cut costs is simply raising the thermostat. While 72°F might feel luxurious, it is expensive. Experts at Consumer Reports suggest that for every degree you raise your thermostat above 72°F, you can save up to 3% on your cooling bill. Aim for 78°F when you are home and higher when you are away. If 78°F feels too warm, try increasing the temperature by one degree every few days to help your body acclimatize.

Master Your Windows

Solar heat gain through windows is a massive contributor to internal heat. Sunlight hitting your windows acts like a greenhouse, trapping heat inside.

- Close blinds and curtains: Keep window coverings closed on south and west-facing windows during the day.

- Use blackout curtains: If you already own them, ensure they are drawn before the sun hits the glass.

- Open windows at night: If the temperature drops significantly at night, turn off the AC and open windows to flush the house with cool air, then close them first thing in the morning to trap that coolness inside.

Use Ceiling Fans Correctly

Fans cool people, not rooms, by creating a wind-chill effect. This allows you to raise the thermostat by about 4°F with no loss in comfort. Ensure your ceiling fans are rotating counter-clockwise (pushing air down) during the summer. Turn fans off when you leave the room; otherwise, you are just paying for electricity to move air around an empty space.

The Summer Maintenance Checklist

A neglected air conditioner consumes significantly more energy to provide the same amount of cooling. Regular maintenance ensures your system runs at peak efficiency.

Consider this part of your broader spring financial cleanup to ensure your home is running efficiently before the heat spikes.

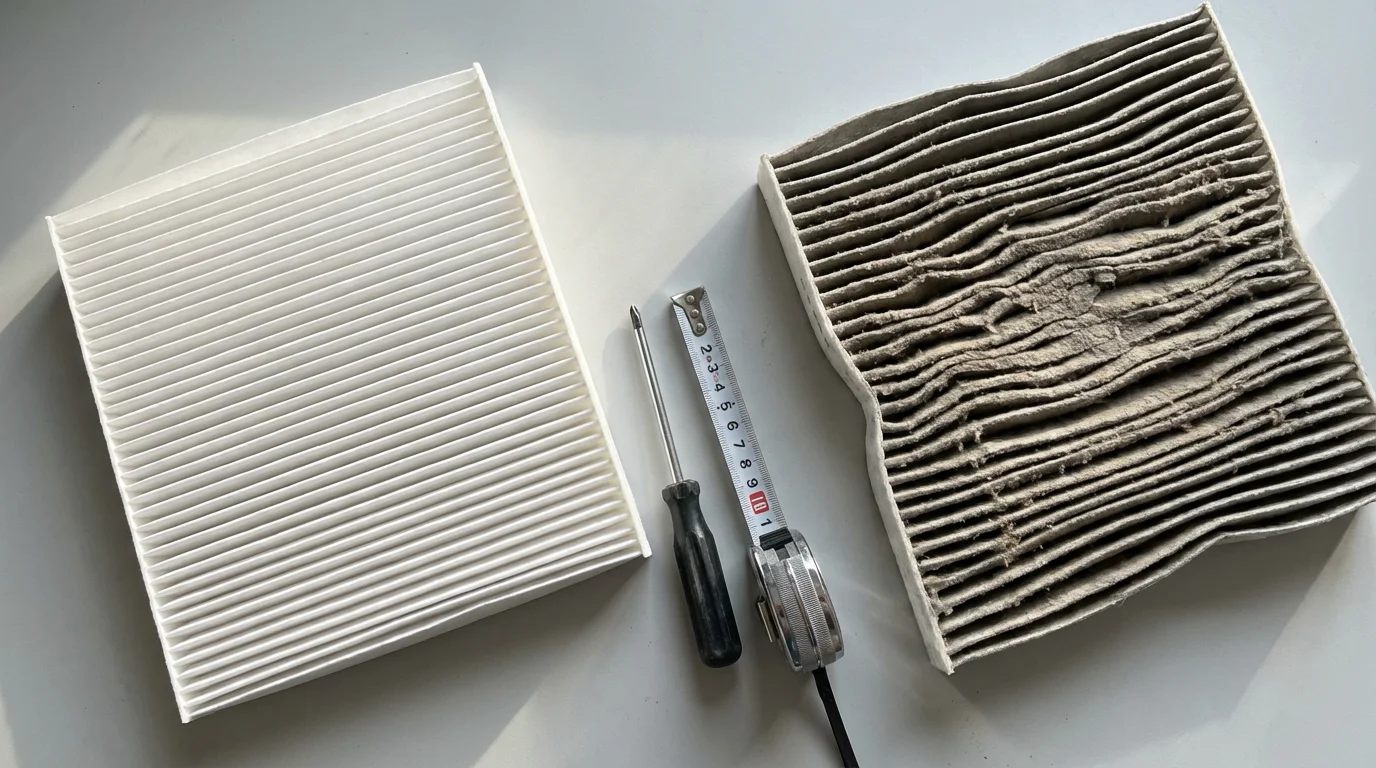

Change Your Filters

A clogged air filter restricts airflow, forcing the system to run longer and harder. This not only drives up your electric bill but also shortens the lifespan of your unit. Check your filter every 30 days during peak summer months. If it looks dirty, change it. This simple $10 task can lower your air conditioner’s energy consumption by 5% to 15%.

Clean the Outdoor Unit

Your outdoor condenser unit needs to breathe. Over the fall and spring, it likely accumulated leaves, dirt, and cottonwood seeds. Clear away any vegetation within two feet of the unit. Gently hose down the fins (with the power off) to remove dust buildup, which helps the unit release heat more effectively.

Reducing Internal Heat Sources

Your AC unit fights a war on two fronts: the heat coming from outside and the heat you generate inside. By reducing internal heat, you give your AC a break.

- Cook smart: Avoid using the oven on hot days. It can raise your kitchen temperature by several degrees. Use a microwave, air fryer, slow cooker, or grill outside instead.

- Laundry timing: Run your dryer early in the morning or late at the evening. The dryer not only uses electricity but often vents some heat back into the house.

- Lighting: If you haven’t switched to LED bulbs yet, summer is the time to do it. Old incandescent bulbs release 90% of their energy as heat. Switching to LEDs keeps your rooms cooler.

As illustrated above, your savings strategy should be built on a foundation of free habits before moving toward paid upgrades.

Smart Tech and Structural Upgrades

If you have some room in your budget, certain upgrades pay for themselves over time through reduced utility bills.

You can also use cashback apps when purchasing supplies like filters or smart thermostats to get a portion of your investment back.

Smart Thermostats

A smart thermostat automatically adjusts the temperature based on your schedule. It can learn when you are away and raise the temperature to save money, then cool the house down right before you return. According to NerdWallet, installing a programmable or smart thermostat is a strategic move that can reduce heating and cooling costs by roughly 10% annually.

Seal and Insulate

The cool air you pay for shouldn’t escape through cracks in your home.

- Weatherstripping: Apply inexpensive weatherstripping around doors and windows to stop drafts.

- Caulking: Seal cracks around window frames where air might leak out.

- Attic Insulation: If your attic insulation is level with or below your floor joists, adding more can significantly reduce heat transfer from your roof into your living space.

Comparing Cost vs. Savings (ROI)

Not all energy-saving moves are created equal. The table below outlines the estimated cost versus potential savings for common cooling strategies.

| Strategy | Estimated Cost | Potential Savings | Difficulty Level |

|---|---|---|---|

| Raise Thermostat (72° to 78°) | $0 | 10-15% of cooling bill | Easy |

| Change Air Filter | $10 – $20 | 5-15% energy efficiency | Easy |

| Install Smart Thermostat | $100 – $250 | 10% annual HVAC costs | Moderate |

| Seal Air Leaks (Caulk/Strip) | $20 – $50 | 10-20% heating/cooling | Moderate |

| Professional Duct Cleaning/Sealing | $300 – $500 | Variable (improves air quality) | Professional Required |

Utility Programs and Financial Aid

Your utility provider likely offers programs to help manage high summer bills. Check their website or call customer service to ask about specific options.

Budget Billing

Most utility companies offer “budget billing” or “level pay.” This averages your annual usage into equal monthly payments. While this doesn’t technically lower your total annual cost, it prevents the shock of a massive July or August bill, making budgeting much easier.

Time-of-Use Plans

Some providers offer cheaper electricity rates during off-peak hours (usually mornings and late nights). If you can shift your laundry and dishwasher usage to these times, you can lower your bill. However, be careful—rates during peak hours (often 4 PM to 9 PM) are significantly higher on these plans.

Assistance for Low-Income Households

If you are struggling to pay your cooling bills, federal assistance may be available. The Low Income Home Energy Assistance Program (LIHEAP) helps eligible households with energy costs. You can find more information on eligibility at USA.gov Benefits.

Common Pitfalls to Avoid

In the rush to save money, it is easy to make mistakes that actually cost you more or damage your home.

- Closing vents in unused rooms: It seems logical to close vents in empty rooms, but modern central air systems are designed to balance pressure throughout the whole house. Closing too many vents increases pressure in the ducts, which can cause leaks and wear out your blower motor faster.

- Turning the AC off completely: If you turn your AC off while you are at work on a 95°F day, the house will heat up intensely. When you return, the unit has to run continuously for hours to remove that heat and humidity, which often uses more energy than simply maintaining a moderate temperature (like 78°F) throughout the day.

- Ignoring humidity: Your AC removes moisture as well as heat. If you oversize your AC unit or short-cycle it, it won’t run long enough to dehumidify the air, leaving your home feeling clammy and potentially encouraging mold growth.

When to Consult a Financial Professional

While changing filters and adjusting thermostats are DIY tasks, some situations require expert guidance. Here is when you should bring in a pro:

- Financing Major Upgrades: If you are considering taking out a loan for new windows, solar panels, or a new HVAC system, consult a financial advisor to ensure the debt makes sense for your long-term financial plan.

- Debt Management: If you are already falling behind on utility bills and credit payments, a credit counselor can help. The National Foundation for Credit Counseling (NFCC) offers low-cost or free advice for managing debt.

- Complex Investments: For significant energy investments like geothermal systems, speak with a tax professional to understand available federal and state tax credits.

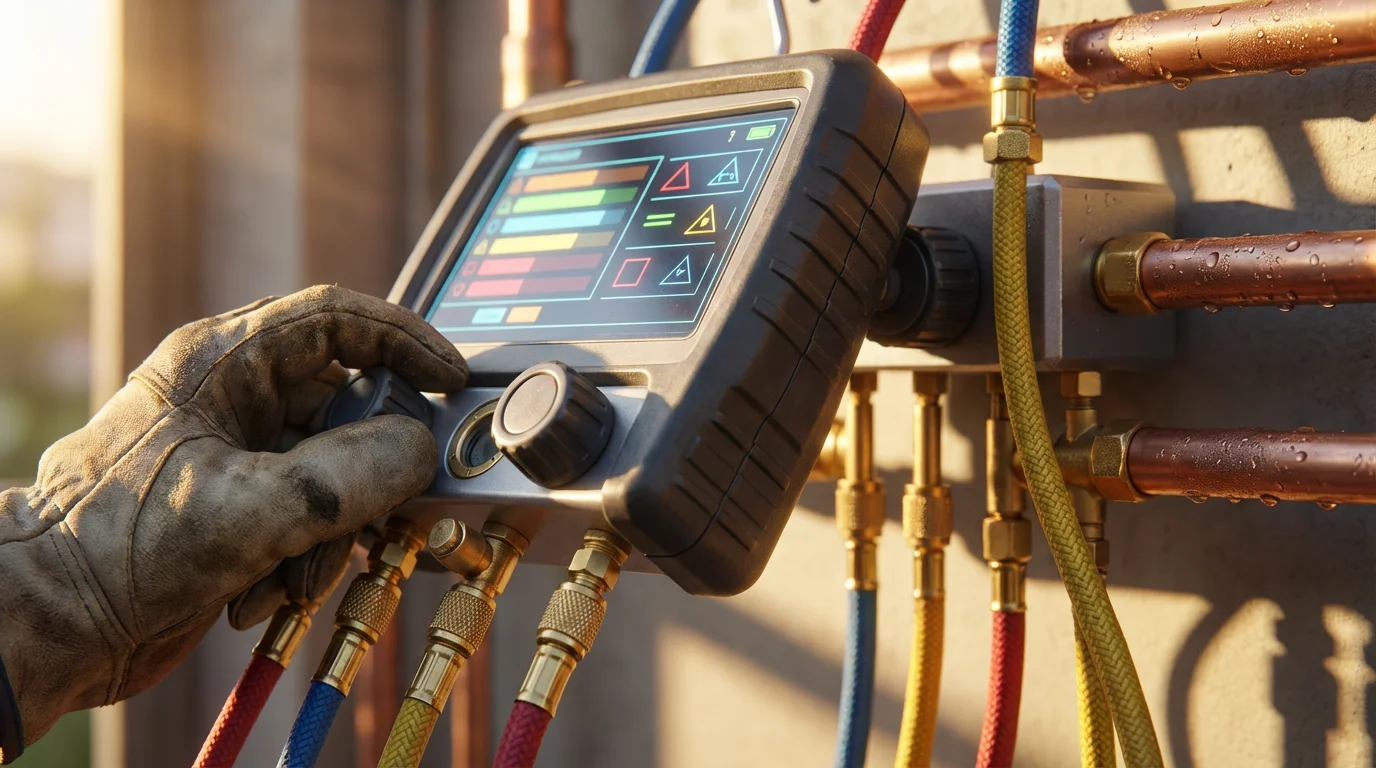

Remember, DIY approaches have limits. Attempting electrical work or refrigerant handling yourself can be dangerous and illegal. Always hire licensed contractors for HVAC repairs.

Frequently Asked Questions

Does leaving a ceiling fan on in an empty room keep the house cool?

No. Ceiling fans cool people, not rooms, through the wind-chill effect. Leaving a fan on in an empty room only wastes electricity and adds a tiny amount of heat from the motor. Always turn fans off when you leave the room.

Should I replace my old AC unit to save money?

Maybe. According to Bankrate, replacing an AC unit that is over 10-15 years old with a high-efficiency Energy Star model can reduce cooling costs by 20% to 40%. However, this is a large upfront investment ($4,000+), so calculate the payback period carefully before buying.

Is it better to keep the AC at a constant temperature or turn it up when I’m away?

It is generally better to turn the thermostat up (e.g., to 82°F) when you are away for more than 4 hours. This reduces the total heat load on the house. Smart thermostats can handle this automatically so the house is cool by the time you return.

When should I consult a professional about my cooling bills?

If your bill spikes unexpectedly without a change in weather or usage, or if your AC runs constantly but doesn’t cool the house, call an HVAC technician immediately. This usually indicates a mechanical failure or a refrigerant leak.

Are there risks to sealing my house too tightly?

Yes. While sealing leaks saves energy, a house that is too tight can trap indoor pollutants, moisture, and carbon monoxide. If you do extensive sealing, ensure you have proper ventilation and working carbon monoxide detectors.

Do solar screens actually work?

Yes, solar screens installed on the exterior of your windows can block 70% to 90% of solar energy before it hits the glass. This is one of the most effective ways to reduce heat gain in rooms with direct sun exposure.

What if I rent my home?

Renters can still save! Focus on portable solutions: use blackout curtains, use fans, adjust the thermostat, and ask your landlord to change the air filters regularly. You can also ask if they would consider installing a smart thermostat if you pay for the device.

Last updated: January 2026. Information accurate as of publication date. Financial regulations, rates, and programs change frequently—verify current details with official sources.

This article was reviewed for accuracy by our editorial team.

For trusted financial guidance, visit

Federal Deposit Insurance Corporation (FDIC),

Securities and Exchange Commission (SEC) and

USA.gov Benefits.

Important: EasyMoneyPlace.com provides educational content only. We are not licensed financial advisors, tax professionals, or registered investment advisers. This content does not constitute personalized financial, tax, or legal advice. Laws and regulations change frequently—verify current information with official sources.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Individual financial situations vary, and we encourage readers to consult with qualified professionals for personalized guidance. For those experiencing financial hardship, free counseling is available through the National Foundation for Credit Counseling.

Leave a Reply