Debt often creeps up slowly. It starts with a student loan, then a car payment, followed by a few furniture purchases on a credit card. For a while, everything feels manageable. But eventually, you might notice a subtle shift—the balance on your statement stops going down, or you feel a knot in your stomach when you check the mail. You aren’t alone in this feeling.

Understanding the difference between manageable debt and “too much” debt is the first step toward reclaiming your financial freedom. It isn’t just about the total dollar amount you owe; it is about how that debt impacts your daily life, your future goals, and your peace of mind. Recognizing the warning signs early gives you the power to change course before a financial crisis hits.

Audience Scope: This guide is for U.S. residents managing personal or household finances. If you have complex circumstances such as business ownership, high net worth, or international assets, we recommend consulting with a qualified financial professional.

Key Takeaways

- Know your numbers: Your Debt-to-Income (DTI) ratio provides a concrete mathematical warning sign that you shouldn’t ignore.

- Emotional cues matter: Anxiety, avoidance, and losing sleep are legitimate indicators that your debt load has become unsustainable.

- Minimum payments are a trap: Paying only the minimums keeps you in debt for decades and drastically increases the total interest you pay.

- Action beats avoidance: Proven strategies like the Debt Snowball or Avalanche methods can help you attack balances systematically.

- Professional help is available: There is no shame in seeking guidance from non-profit credit counselors when self-guided methods aren’t enough.

What Counts as “Too Much” Debt?

Before diving into the specific signs, it helps to define what “too much” actually means. Financial health isn’t one-size-fits-all, but experts generally agree on certain thresholds. Debt becomes a problem when it restricts your ability to build wealth, save for emergencies, or cover your basic living expenses without borrowing more. If your past choices are dictating your future opportunities, it is time to reassess.

“You must gain control over your money or the lack of it will forever control you.” — Dave Ramsey

Sign #1: Your Debt-to-Income Ratio Exceeds 43%

One of the most objective ways to measure your debt load is the Debt-to-Income (DTI) ratio. Lenders use this number to decide if you can afford a mortgage, but you can use it to check your own financial pulse.

Your DTI is the percentage of your gross monthly income that goes toward paying debts. According to the Consumer Financial Protection Bureau (CFPB), a DTI of 43% is generally the highest ratio a borrower can have and still get a qualified mortgage. Ideally, for healthy personal finance, you want this number to be 36% or lower.

How to calculate it:

- Add up your monthly debt payments (rent/mortgage, student loans, car loans, credit card minimums). Do not include groceries or utilities.

- Divide that number by your gross monthly income (your income before taxes).

- Multiply by 100 to get the percentage.

Example: If you earn $5,000 a month gross and your total debt payments are $2,500, your DTI is 50%. This is a major red flag indicating you are overleveraged.

Sign #2: You Only Make Minimum Payments

If you look at your credit card bill and feel relieved that you can scrape together the minimum payment, you are likely in the danger zone. Minimum payments are designed to keep you in debt as long as possible while maximizing profit for the lender.

To break this cycle, you need to implement proven strategies to pay off credit card debt rather than letting interest accumulate.

When you only pay the minimum, the majority of your money goes toward interest, not the principal balance. This creates a cycle where the balance barely moves despite years of payments.

The Cost of Minimums:

Imagine you owe $5,000 on a credit card with an 18% APR. If your minimum payment is 2% of the balance ($100), and you only pay that amount:

- It will take you over 24 years to pay off the debt.

- You will pay roughly $6,923 in interest alone—more than the original amount you borrowed.

Sign #3: You Get Denied for New Credit

Have you applied for a credit card, a car loan, or a credit limit increase recently and been rejected? This is the financial system telling you that you look risky on paper.

While a denial is discouraging, you can eventually recover by rebuilding your credit score after you’ve reduced your utilization.

Lenders look at your credit utilization ratio—how much credit you are using compared to your limits. If your cards are maxed out, your credit score drops significantly. According to Investopedia, utilizing more than 30% of your available credit can hurt your score, and maxing out cards signals to lenders that you may be relying on credit to survive.

Sign #4: You Have No Savings Buffer

Living without an emergency fund is a precarious way to exist. If every dollar you earn goes immediately to bills and debt service, you have zero margin for error. This means a single unexpected event—a blown tire, a medical copay, or a home repair—forces you to borrow more money just to solve the problem.

If your cash flow is tight, there are specific methods to get out of debt on a low income by prioritizing essential expenses.

The Federal Deposit Insurance Corporation (FDIC) emphasizes that having an emergency fund is essential for financial stability. If your debt payments are so high that you cannot save even $50 a month, your debt is officially restricting your ability to protect yourself.

Sign #5: You Use Credit for Daily Necessities

Credit cards offer convenience and rewards, but they should not be an extension of your income. If you find yourself swiping your Visa for groceries, gas, or utilities because your checking account is empty, you are living beyond your means.

Many people fall for common debt myths that normalize carrying a balance for everyday living costs.

Using credit for consumables creates a “future tax” on your life. You might be paying for that gallon of milk you bought in March for the next six months, plus interest. This habit suggests that your cash flow is negative—more money is going out than coming in—and debt is filling the gap.

Sign #6: You Shuffle Balances Without Paying Them Down

Balance transfers can be a smart tool if used correctly, such as moving high-interest debt to a 0% APR card to pay it off faster. However, if you are moving debt from Card A to Card B just to keep the account current or to free up credit on Card A so you can spend more, you are playing a shell game.

Instead of playing a shell game with cards, you might consider debt consolidation loans to lower your interest rate and simplify your monthly payments.

This behavior is often a sign of desperation. You aren’t reducing the debt; you are just moving the problem around. Eventually, you run out of places to move the balance, and the fees associated with these transfers add up quickly.

Sign #7: You Borrow from Retirement Accounts

Raiding your 401(k) or IRA to pay off consumer debt is one of the most damaging financial moves you can make. While it might solve a short-term cash flow problem, it jeopardizes your long-term future.

According to the Internal Revenue Service (IRS), early withdrawals from retirement accounts often come with a 10% penalty in addition to income taxes. Furthermore, you lose the compound growth that money would have earned over the next 10, 20, or 30 years. If you view your retirement fund as a piggy bank for current bills, your debt situation has become critical.

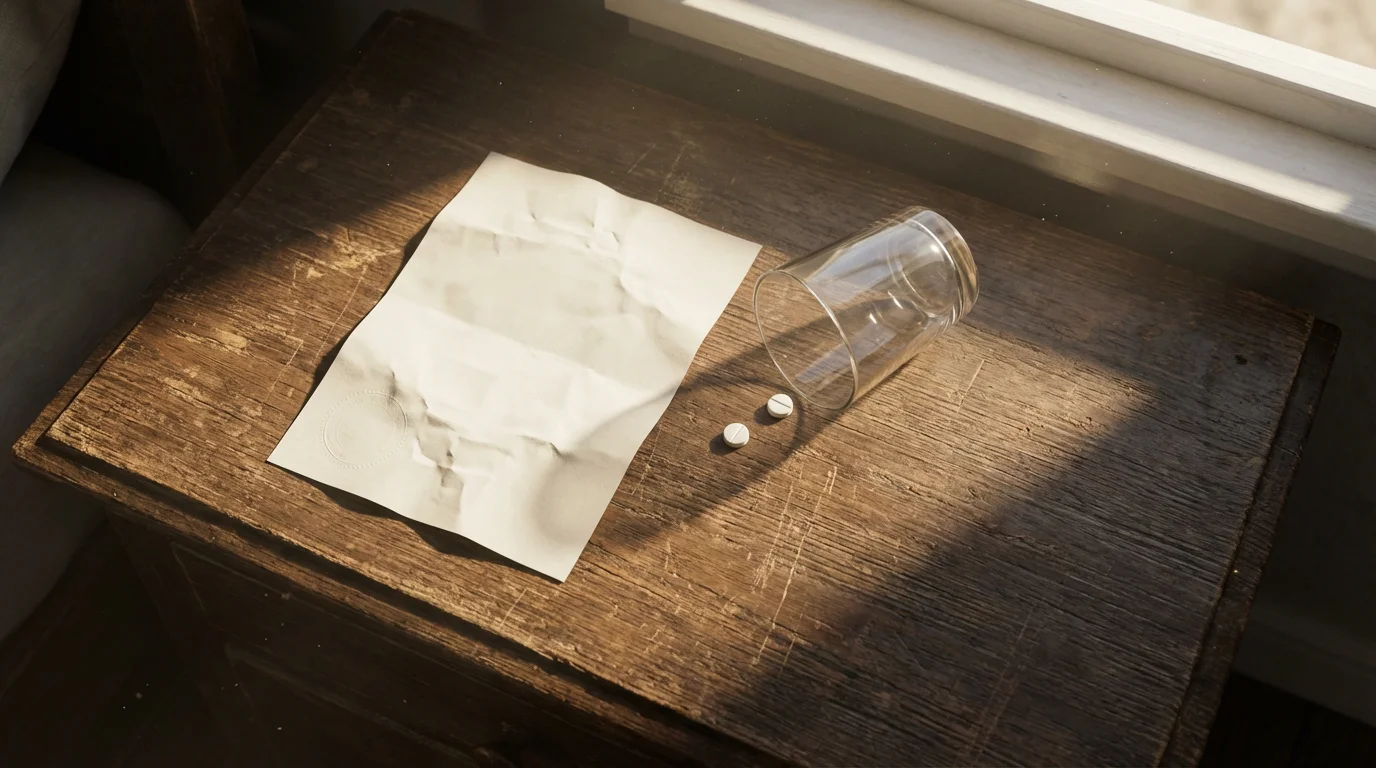

Sign #8: Debt is Causing Physical or Mental Stress

Not all signs are mathematical. Your body often knows you are in trouble before your spreadsheet does. Financial stress manifests in various ways:

If the financial pressure is affecting your health, learning how to negotiate with creditors can provide a path toward more manageable payments.

- Loss of sleep or insomnia due to money worries.

- Physical symptoms like headaches, stomach issues, or high blood pressure.

- A feeling of dread when the phone rings or when you check your email.

- Avoiding opening mail because you don’t want to see the numbers.

If your debt is affecting your health or your happiness, you have too much of it, regardless of what the math says.

Sign #9: You Hide Spending from Family

Financial infidelity involves hiding purchases, bills, or the true extent of your debt from your spouse or family members. If you find yourself rushing to the mailbox to grab a credit card statement before your partner sees it, or claiming a new purchase was “on sale” or “a gift” when it wasn’t, shame is driving your behavior.

Secrecy usually stems from the knowledge that the spending is problematic. This isolation makes the problem worse because it prevents you from working together with your partner to find a solution.

Sign #10: You Are Receiving Collection Calls

This is the most urgent sign. If your debts have been sold to collection agencies, or if your original creditors are calling you daily demanding payment, you are in a financial emergency.

If you are struggling to keep up, learning how to negotiate with creditors and lower your debt can help you find an alternative to the collections cycle.

When debt reaches this stage, your credit score is already suffering damage, and you may be at risk of legal action, wage garnishment, or liens against your property. According to the Federal Trade Commission (FTC), you have rights regarding how debt collectors can contact you, but ignoring them will not make the debt disappear.

The Action Plan: How to Turn It Around

If you recognized yourself in several of these signs, take a deep breath. You are not trapped. Thousands of people have faced similar situations and dug their way out. Here is a practical, step-by-step plan to regain control.

1. Face the Numbers

Stop avoiding the mail. Open every statement, log into every account, and list every single debt you owe. Create a simple spreadsheet with columns for: Creditor Name, Total Balance, Interest Rate, and Minimum Payment. Seeing the total might be scary, but you cannot fight a monster you cannot see.

2. Create a Zero-Based Budget

You need to stop the bleeding immediately. Create a budget where your income minus your expenses equals zero. Every dollar must have a job. Prioritize the “Four Walls” first: food, utilities, shelter, and transportation. Cut all non-essential spending—streaming services, dining out, and subscriptions—until you have traction.

3. Choose Your Payoff Strategy

Two primary methods dominate debt repayment. Choose the one that fits your psychology best.

| Strategy | How it Works | Best For… |

|---|---|---|

| Debt Snowball | List debts from smallest balance to largest. Pay minimums on everything, but throw all extra cash at the smallest debt. | People who need quick wins and motivation. Seeing debts disappear quickly builds momentum. |

| Debt Avalanche | List debts from highest interest rate to lowest. Attack the highest interest rate first while paying minimums on the rest. | People who are mathematically driven and want to save the most money on interest over time. |

4. Lower Your Interest Rates

Call your credit card companies and ask for a lower rate. It sounds too simple to work, but it often does, especially if you have a history of on-time payments. Alternatively, consider a debt consolidation loan from a local credit union if—and only if—you have corrected the spending habits that got you into debt. Do not use a loan to clear your cards only to run the balances up again.

Common Pitfalls to Avoid

As you work to get out of debt, be wary of “quick fixes” that can make your situation worse.

- Payday Loans: Never use a payday loan to pay off a credit card. The APRs on these loans can exceed 400%, trapping you in a cycle of debt that is nearly impossible to escape.

- Debt Settlement Companies: Be cautious of for-profit companies promising to settle your debt for pennies on the dollar. The CFPB warns that these programs often charge high fees and may encourage you to stop paying your bills, which further destroys your credit score and invites lawsuits.

- Closing Old Accounts too Early: While you shouldn’t use the cards, keeping your oldest credit accounts open (even with a zero balance) helps your credit history length. Close them only if the temptation to spend is too high.

When to Consult a Financial Professional

Sometimes, DIY methods aren’t enough. If your financial hole is too deep, seeking professional help is a sign of strength, not weakness. You should consider consulting a professional if:

- You are facing legal action: If you have received a court summons or notice of wage garnishment.

- You cannot cover basic necessities: If paying debt means you can’t pay rent or buy food.

- The math doesn’t work: If your total debt (excluding mortgage) is more than 50% of your gross annual income, it may be mathematically impossible to pay off within five years without restructuring.

- Mental health is suffering: If debt stress is leading to severe anxiety or depression.

Who to call: Start with a non-profit credit counselor. Organizations accredited by the National Foundation for Credit Counseling (NFCC) offer low-cost or free budget counseling and can help set up Debt Management Plans (DMPs) with lower interest rates negotiated directly with creditors.

Frequently Asked Questions

How much debt is considered “normal”?

While debt is common, “normal” doesn’t mean healthy. According to data from the Federal Reserve, the average American carries significant debt. However, financial health is better measured by your Debt-to-Income ratio (aim for under 36%) and net worth, rather than comparing yourself to national averages.

Does checking my own credit report hurt my score?

No. Checking your own credit is considered a “soft inquiry” and has zero impact on your credit score. You should check your report regularly to ensure all listed debts are actually yours. You can get free reports at annualcreditreport.com (authorized by federal law).

Is debt consolidation a good idea?

It depends. Consolidation works if you can secure a lower interest rate and—crucially—if you have fixed the spending behavior that caused the debt. If you consolidate but continue overspending, you will end up with a consolidation loan plus new credit card debt.

When should I consult a professional about my debt?

You should seek professional help if you are using credit to pay for basic living expenses, if you are losing sleep over money, or if you are being sued by creditors. Non-profit credit counseling is a safe first step to explore your options without judgment.

What are the risks of debt settlement?

Debt settlement involves stopping payments to creditors to negotiate a lower payoff amount. The risks include severe damage to your credit score (lasting up to seven years), potential lawsuits from creditors, and tax bills on the “forgiven” debt amount, which the IRS may count as income.

Should I pay off my mortgage early?

Generally, high-interest consumer debt (credit cards, personal loans) should be prioritized over mortgage debt. Mortgage rates are typically lower and the interest may be tax-deductible. Focus on clearing debts with interest rates above 5-7% before aggressively attacking your mortgage.

What is the Statute of Limitations on debt?

This is the time period during which a creditor can legally sue you for a debt. It varies by state and type of debt (usually 3 to 10 years). However, the debt does not disappear; you still owe it, and collectors can still call, but they cannot win a judgment in court if the statute has expired.

Can I use my 401(k) to pay off credit cards?

You can, but financial experts almost universally advise against it. You will likely pay income tax plus a 10% penalty if you are under age 59½. More importantly, you are robbing your future self of compound interest. It is usually better to explore other options like a Debt Management Plan.

Last updated: January 2026. Information accurate as of publication date. Financial regulations, rates, and programs change frequently—verify current details with official sources.

This article was reviewed for accuracy by our editorial team.

For trusted financial guidance, visit

Investopedia,

Bankrate,

Consumer Reports,

The Balance, and

Kiplinger.

Important: EasyMoneyPlace.com provides educational content only. We are not licensed financial advisors, tax professionals, or registered investment advisers. This content does not constitute personalized financial, tax, or legal advice. Laws and regulations change frequently—verify current information with official sources.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Individual financial situations vary, and we encourage readers to consult with qualified professionals for personalized guidance. For those experiencing financial hardship, free counseling is available through the National Foundation for Credit Counseling.

Leave a Reply