Prime Day has evolved from a simple summer sale into a massive retail event that rivals Black Friday. For 48 hours, the internet is flooded with “must-have” deals, countdown clocks, and lightning sales designed to trigger your fear of missing out. But here is the reality: Spending $200 on a blender you didn’t need—even if it was 40% off—isn’t saving money. It is spending $200.

To win at Prime Day, you need to shift your mindset from “consumer” to “strategist.” You need a plan that protects your wallet from impulse buys while helping you secure genuine discounts on items you actually need. Whether you are stocking up on household essentials, replacing broken appliances, or looking for early holiday gifts, preparation is your best financial defense.

Audience Scope: This guide is for U.S. residents and everyday shoppers looking to maximize their budget. If you have complex financial circumstances such as business procurement needs, high net worth asset protection concerns, or international shipping requirements, we recommend consulting with a qualified financial professional.

Key Takeaways

- Audit Before You Shop: Review your home inventory to identify genuine needs versus marketing-induced wants.

- Verify the Deal: Use price history tools to ensure the “discount” isn’t based on an inflated original price.

- Set a Hard Cap: Establish a total dollar limit for the event and stick to it, regardless of how good a deal looks.

- Check Competitors: Major retailers like Walmart, Target, and Best Buy run competing sales that often match or beat Prime prices.

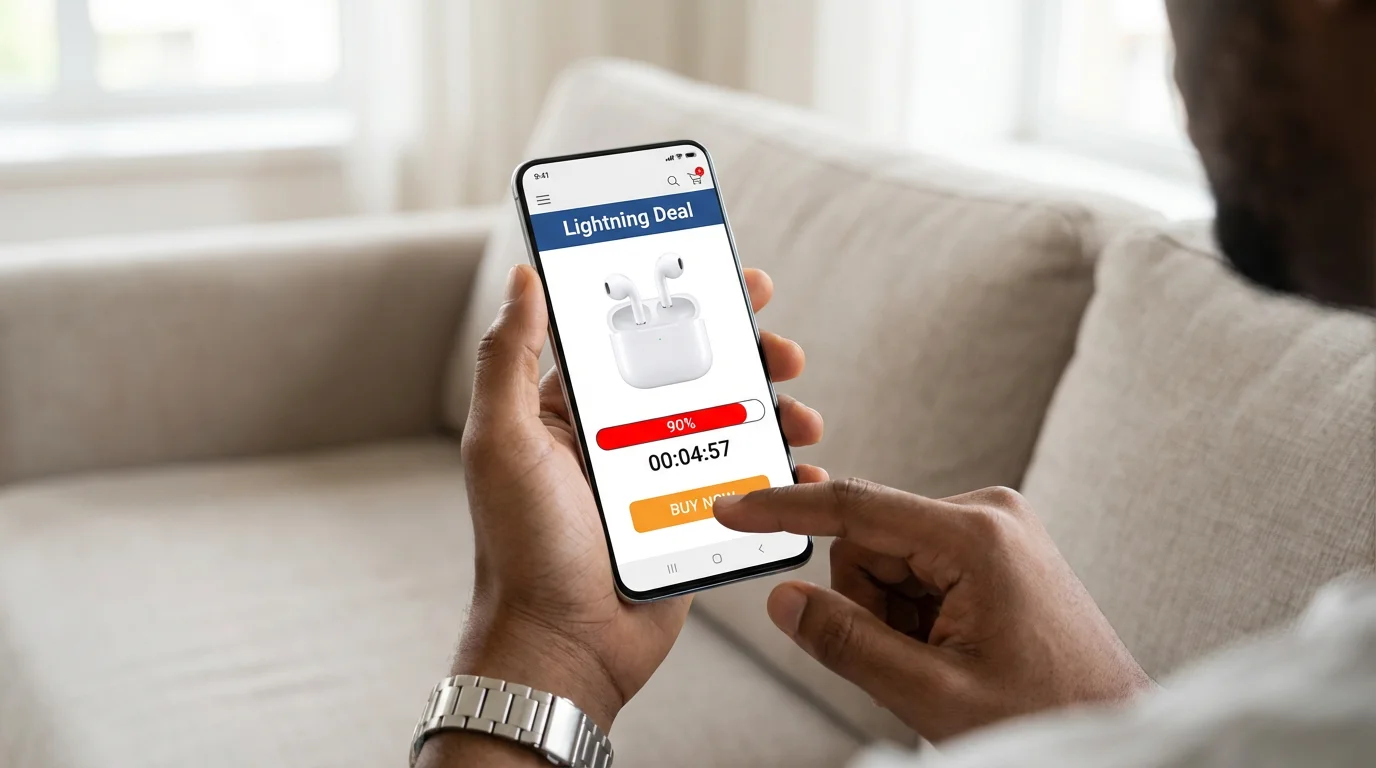

- Ignore the Timer: Lightning deals create artificial urgency; take a breath and evaluate the purchase logic before clicking buy.

The Psychology of the Sale: Why You Feel the Urge to Splurge

Retailers spend millions analyzing consumer behavior to understand exactly what triggers a purchase. During Prime Day, they utilize scarcity and urgency to bypass your logical decision-making processes. When you see a “Lightning Deal” bar that is 85% claimed with a timer counting down, your brain registers a potential loss.

According to the Consumer Financial Protection Bureau (CFPB), marketers often use behavioral psychology to nudge consumers toward spending. Recognizing these triggers is the first step in neutralizing them. You are not just fighting high prices; you are fighting a sophisticated algorithm designed to make you click “Add to Cart.”

The “anchor price” is another common tactic. You see a strikethrough price of $100 next to a sale price of $60. Your brain anchors to the $100, making the $60 feel like a win. However, if the item typically sells for $65, the savings are negligible. Understanding these psychological plays helps you pause and ask: “Would I buy this today if it weren’t on sale?”

Pre-Game Strategy: The 7-Day Prep Plan

Walking into Prime Day without a list is like grocery shopping while hungry—you will end up with a cart full of junk. Implementing a waiting period and a preparation strategy calms the impulse to spend.

Using a few Amazon hacks like checking for warehouse deals or optimizing your cart can further increase your savings.

One Week Before:

- The Physical Audit: Open your pantry, linen closet, and electronics drawer. Do you really need bulk paper towels, or do you have six rolls hidden in the back? Write down exactly what you need to replenish.

- The Wish List Migration: Move items from your mental wish list to a physical or digital list. Prioritize them by urgency.

- Clean Your Cookies: Clear your browser cache. Sometimes retailers show different pricing based on your browsing history.

24 Hours Before:

- Check Your Address and Payment Info: Ensure your details are current to avoid checkout panic, which often leads to mistakes.

- Turn Off 1-Click Ordering: This friction is good. It forces you to review your cart one last time before committing.

- Load Your Cart (Strategically): Add the specific items you identified in your audit to your cart or “Save for Later” list. This allows you to see instantly if the price drops when the sale starts.

Setting a Realistic Prime Day Budget

A budget is not a restriction; it is a permission slip to spend without guilt. Before you look at a single deal, determine your “Walk Away” number. This is the absolute maximum amount of money you can spend during the event without impacting your bills, savings goals, or debt repayment plan.

For a broader look at managing your monthly finances, consider implementing the 50/30/20 budget rule to ensure your ‘wants’ don’t overwhelm your ‘needs.’

If you are currently carrying credit card debt, your Prime Day budget should arguably be zero, unless you are buying essentials that are cheaper on Amazon than your local grocery store. Bankrate frequently highlights how high-interest credit card debt cancels out the benefits of sales discounts. If you save 20% on a TV but pay 25% APR on the credit card balance for a year, you have lost money.

The “Found Money” Rule: Consider funding your Prime Day shopping solely with “found money”—cash back rewards, gift cards you’ve been hoarding, or extra income from a side hustle. If it doesn’t come from your primary checking account, it won’t disrupt your monthly cash flow.

Essential Tools for Price Tracking

Never trust the “List Price” displayed on the product page. Sellers often inflate the base price weeks before a sale to make the Prime Day discount look deeper than it is. To combat this, you need third-party history tools.

Top Price Checkers

- CamelCamelCamel: This free tool tracks Amazon price history. You can paste a product URL into their search bar to see a graph of the item’s price over time. If the “lowest price ever” was $50 in March, and the Prime Day deal is $60, you know it’s not a historic low.

- Keepa: Similar to CamelCamelCamel, Keepa offers a browser extension that embeds a price history chart directly onto the Amazon product page. This provides instant context without needing to leave the tab.

- Honey: This extension not only tracks prices but also scans for coupon codes at checkout. While coupons are rarer on Prime Day, every dollar counts.

According to the Federal Trade Commission (FTC), comparison shopping is one of the most effective ways to protect yourself from deceptive pricing. By using these tools, you are verifying that the deal is legitimate.

Category Breakdown: What to Buy vs. What to Skip

Not all deals are created equal. Amazon aggressively discounts its own hardware, while third-party sellers vary wildly. Here is a general guide on where the real value lies.

Comparing this event to the best time to buy everything can reveal that while electronics are great now, other categories are better left for later in the year.

| Category | Verdict | Strategy |

|---|---|---|

| Amazon Devices (Echo, Kindle, Fire TV) | BUY | These hit their lowest prices of the year. If you want one, buy it now. |

| Small Kitchen Appliances (Instant Pot, Air Fryers) | BUY | Major brands often use Prime Day to clear inventory. Look for bundled deals. |

| Televisions | CAUTION | Cheap models are often lower-tier variants made specifically for holidays (“derivative models”). Check model numbers carefully. |

| Clothing & Fashion | SKIP | Unless it’s Amazon Essentials basics, fashion sales are usually better during end-of-season clearance events. |

| Toys & Games | WAIT | While there are some deals, Black Friday usually offers better pricing and wider selection for toys. |

| Household Consumables (Detergent, Diapers) | BUY | Look for extra coupons on “Subscribe & Save” items. These offer genuine savings on things you will buy anyway. |

The Competitor Landscape: Look Beyond the Smile

Prime Day has forced the entire retail industry to compete. Walmart, Target, Best Buy, and even direct-to-consumer brands run “Anti-Prime Day” sales during the same window. Often, these retailers will price-match Amazon without requiring a membership fee.

The “No Membership” Advantage: Remember that to get Prime Day deals, you need a Prime membership, which costs money. If Target has the same vacuum for the same price, and you don’t have to pay a subscription fee to buy it, Target is the better deal. Additionally, brick-and-mortar stores offer easier returns—you can just walk into the store rather than repackaging and shipping a box.

Check Consumer Reports for unbiased reviews of products sold across different retailers. They often highlight which retailer offers the best warranty or return policy for specific electronics, which adds hidden value to the purchase.

Common Pitfalls and Marketing Tricks

Even seasoned shoppers can get tripped up by sophisticated marketing tactics. Awareness is your safety net.

The “Lightning Deal” Trap

Lightning deals are time-sensitive offers with limited inventory. They feature a progress bar showing what percentage of the deal has been claimed. This is pure FOMO (Fear Of Missing Out). If you see a Lightning Deal for a brand you have never heard of, be skeptical. It is likely a generic product with a markup, discounted to look like a bargain.

Fake Reviews

A product might have 4.5 stars, but if you look closely, are the reviews for the actual item? Sometimes sellers “hijack” old product listings that had good reviews (like a phone case) and swap the image and description to a new product (like a blender). The 5-star rating remains, misleading you. Always read the most recent written reviews to ensure they match the product you are looking at.

The “Bundle” Bloat

Retailers often bundle a popular item (like a camera) with low-quality accessories (a cheap tripod, a slow memory card, a flimsy bag) to justify a higher price point. Calculate the cost of the main item alone. Often, it is cheaper to buy the main item solo and pick out high-quality accessories separately.

Maximizing Rewards Without Debt

If you have the cash on hand to pay off your balance immediately, using the right credit card can add another 5% to your savings. However, this strategy requires strict discipline.

Many rewards cards offer rotating categories or specific bonuses for online retailers. According to NerdWallet, maximizing credit card rewards requires paying the balance in full every month; otherwise, interest charges will quickly eclipse any points or cash back you earn.

Stacking Opportunities:

- Cashback Portals: Sites like Rakuten often offer increased cash back rates at competitors like Walmart or Macy’s during the Prime Day window.

- Credit Card Offers: Check your credit card portal for “merchant offers.” You might find a “Spend $50, get $10 back” offer for a specific retailer.

- Gift Card Bonuses: Occasionally, retailers offer a bonus for buying a gift card (e.g., “Buy $50, get $10”). If you are definitely making a purchase, buy the gift card first, then use it to buy the item.

When to Consult a Financial Professional

While shopping strategies can be managed personally, certain financial behaviors or situations require professional guidance. Understanding when to seek help is a sign of financial maturity.

- Compulsive Shopping Patterns: If you find yourself unable to resist sales despite negative consequences, or if you hide purchases from family members, this may indicate a spending compulsion. A certified credit counselor can help you build healthier habits.

- Severe Debt Loads: If you are struggling to make minimum payments on existing debt, adding more purchases—even at a discount—is dangerous. Consult a nonprofit credit counselor through the National Foundation for Credit Counseling (NFCC).

- Budgeting for Major Life Goals: If you are unsure how discretionary spending fits into larger goals like retirement or buying a home, a Certified Financial Planner (CFP) can help you construct a comprehensive financial plan.

You can verify a professional’s credentials using the Certified Financial Planner Board of Standards or finding a counselor via the NFCC. Do not rely on DIY methods if your financial stability is at risk.

Frequently Asked Questions

Is Amazon Prime membership required to get the deals?

Generally, yes. Most “Prime Day” specific deals are exclusive to members. However, Amazon offers a free 30-day trial for new members. You can sign up for the trial, shop the sale, and cancel before the 30 days are up if you don’t wish to keep the service. Just set a reminder on your phone so you don’t forget to cancel.

Are the discounts on Prime Day real?

Some are, but many are not. As noted by Consumer Reports, pricing algorithms fluctuate constantly. A “40% off” deal might be based on a Manufacturer’s Suggested Retail Price (MSRP) that no one actually pays. Always use price history tools like CamelCamelCamel to verify if the current price is actually a deal compared to the item’s average street price.

When should I consult a professional about my spending?

You should consult a professional if your spending habits are causing you to miss bill payments, incur high-interest debt, or cause stress in your relationships. Organizations like the NFCC offer free or low-cost counseling to help you regain control. Shopping should never jeopardize your financial security.

What are the risks of using “Buy Now, Pay Later” services on Prime Day?

Services that split payments into four installments can make expensive items seem affordable. The risk is “stacking” multiple plans, where the total monthly obligation becomes unmanageable. Missed payments on these services can result in late fees and negative marks on your credit report. Only use these services if you have the cash available today but choose to spread cash flow for strategic reasons.

Should I wait for Black Friday instead?

It depends on the item. Prime Day is historically better for Amazon-branded devices (Echo, Kindle), back-to-school items, and summer goods. Black Friday tends to offer better deals on major appliances, high-end TVs from major brands (Sony, Samsung), and gaming consoles. If you can wait until November, you often have a wider selection of deals across all retailers.

What if I buy something and the price drops further?

Amazon generally does not offer post-purchase price adjustments. Your best strategy is to return the item (if shipping is free) and repurchase it at the lower price. However, verify the return policy for the specific item before doing this, as some third-party sellers charge restocking fees.

How do I spot a fake product or scam seller?

Check the “Sold By” field under the “Buy Now” button. If it is sold by a third party with a strange name or very few ratings, proceed with caution. Read the 1-star reviews to see if buyers complain about counterfeit goods. Using trusted platforms cited by the FTC helps you stay informed on current online shopping scams.

Last updated: January 2026. Information accurate as of publication date. Financial regulations, rates, and programs change frequently—verify current details with official sources.

This article was reviewed for accuracy by our editorial team.

For trusted financial guidance, visit

Bankrate,

Consumer Reports,

The Balance,

Kiplinger and

Forbes Advisor.

Important: EasyMoneyPlace.com provides educational content only. We are not licensed financial advisors, tax professionals, or registered investment advisers. This content does not constitute personalized financial, tax, or legal advice. Laws and regulations change frequently—verify current information with official sources.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Individual financial situations vary, and we encourage readers to consult with qualified professionals for personalized guidance. For those experiencing financial hardship, free counseling is available through the National Foundation for Credit Counseling.

Leave a Reply